How to Obtain Affordable Car Insurance in Arizona

To secure cheap car insurance in Arizona, it's crucial to compare rates from various providers and seek out local deals. Consulting with a local insurance agent can provide valuable insights on saving money on auto insurance.

Cheap Car Insurance Quotes in Arizona

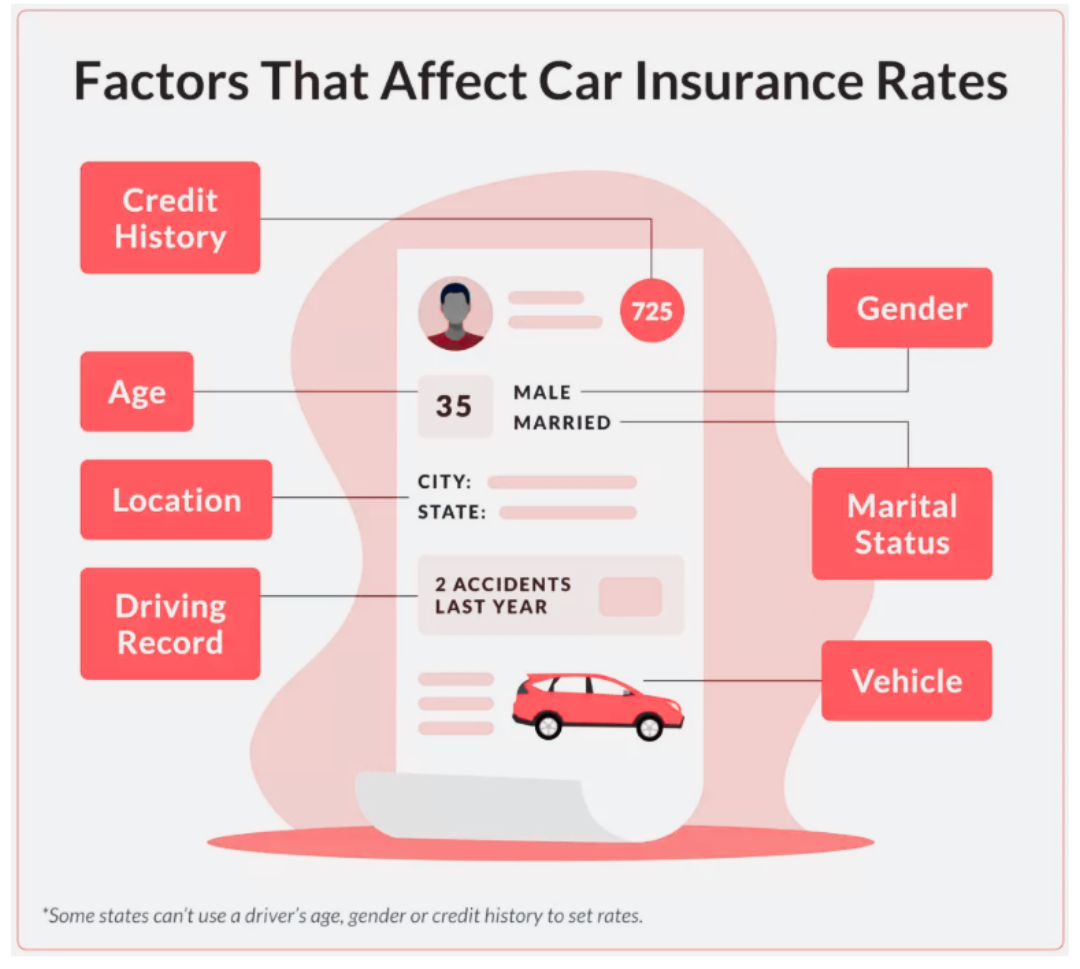

When obtaining a car insurance quote, providers use several factors to calculate your rates.

The most significant factors that insurers consider for car insurance costs in Arizona include:

- Your age

- Your location

- The gender listed on your driver’s license

- Your driving history

- Your credit score

- Your marital status

- The make, model, year, and mileage of your vehicle

- The deductible you choose